The basic curiosity about this topic has been with me for a long time. A recent experience reinvigorated that curiosity. I was in the Von’s wine aisle in Mammoth Lakes, CA, spending (as I do…) way too much time looking at the vast array of offerings. A tall, good looking gentleman who was re-stocking the shelves noticed me, and asked if I wanted some advice. That turned into a 15 minute conversation. Turns out he was not a store employee–he was a winemaker, Andrew Figge, with his name on several of the offerings in that aisle. A few of the slots on Von’s wine aisle are not, it turns out, managed by Vonn’s employees. The distributor, or in this case, the winemaker himself, has that responsibility. Andrew Figge made a 7-hour drive from the Central Coast to Mammoth Lakes to do this, not only for his wines (he had four or five offerings of his own), but for a few other winemakers he was acquainted with in the Central Coast. He stops by a few of his neighbors, picks up a few cases, proceeds to Mammoth Lakes, and happily re-stocks for them. A friend who lives in Mammoth Lakes occasionally checks over his stock in the store calls this winemaker when the stocks are getting low. I came away wondering how common is this sort of relationship between a small-volume winemaker and a big, chain supermarket.

I checked in with subscriber Paul Gregutt, author of Paul Gregutt’s NW Wine Guide (a great resource for wine from Oregon and Washington State–highly recommended!). He thought that my encounter with Andrew Figge in that Von’s was a lightning-in-a-bottle event, rare and getting rarer. “Small winemakers looking for supermarket buyers? They don’t exist.” Supermarkets are quickly heading the other direction altogether, toward more commodity wines and big distributors.

Subscriber Bob Paulinski, a Master of Wine and creator of a popular youtube channel on wine (also highly recommended), agrees with Paul’s basic take. Bob has been involved in marketing of wine at nearly every level: owner of a small specialty wine shop; category lead for wine, spirits and beer for Sam’s Club and later, for Bevmo; Senior VP for beverage alcohol for Cole’s stores in Australia; and more recently a consultant in the wine industry for clients both in the US and abroad. With more than a thousand unique wine offerings in your typical supermarket wine aisle, Bob explained that “…management of the aisle is rarely done in any real sense by the store staff–big alcoholic beverage distributors normally fill that function, providing multi-faceted support to the store staff.”

The direct support provided to the stores by the alcoholic beverage distributors includes: tracking product sales at the store; determining product offerings and placement on the huge array of shelves; arranging for promotional offerings (normally at the cost of the winemakers); and even doing operational management of the in-store inventory (tracking age of product, stocking shelves, etc.). Increasingly, every aspect of this support is driven by data and analytics on what’s selling and what’s not, and at what price.

The distributors providing this support to the store staff themselves have grown larger, mirroring the consolidation and aggregation of supermarkets themselves. So, we have big supermarket chains working with big alcoholic beverage distributors, and that relationship has tilted supermarkets to offer more and more commodity wines. By this, I mean wines that are literally engineered to be produced in large quantities, to appeal to the tastes of a broad swath of consumers, and to be produced so consistently year by year that vintage matters little. Commodity wines exist at every price level. Think: Barefoot Chardonnay (<$10), Kendall Jackson Vintner’s Reserve Chardonnay ($10-15), Ferarri-Carano California Chardonnay ($20-25), and Grgich Hills Napa Valley Estate Chardonnay ($35-40). These are some examples of wines you will see in most supermarkets, and there are similar “ladders” of commodity wines for cabernet sauvignon, pinot noir, etc., as well as other brands of each variety at different price levels.

While every one of the big supermarket chains (Safeway, Savemart, Raley’s, Whole Foods, Nugget, and others) undoubtedly deal with one or more of the big distributors (Southern Glazer’s Wine & Spirits, Republic National Distributors, Breakthru Beverage Group, Youngs Market Company, and others), the relationship between the store staff and the distributor varies by store, somewhat, depending on what consumers the store is serving. The Von’s in Mammoth Lakes, CA that started this post is clearly one where the store staff have tailored the offerings to the recreational visitors–ergo Andrew Figge showing up to restock a few slots. The Savemart a mile from my home in Sacramento, though–it’s as generic and “commodified” as it could be. I thought would look at the wine aisle in a few of the big supermarket retailers in Sacramento, to see how they compare.

Supermarket Wine Price Comparison

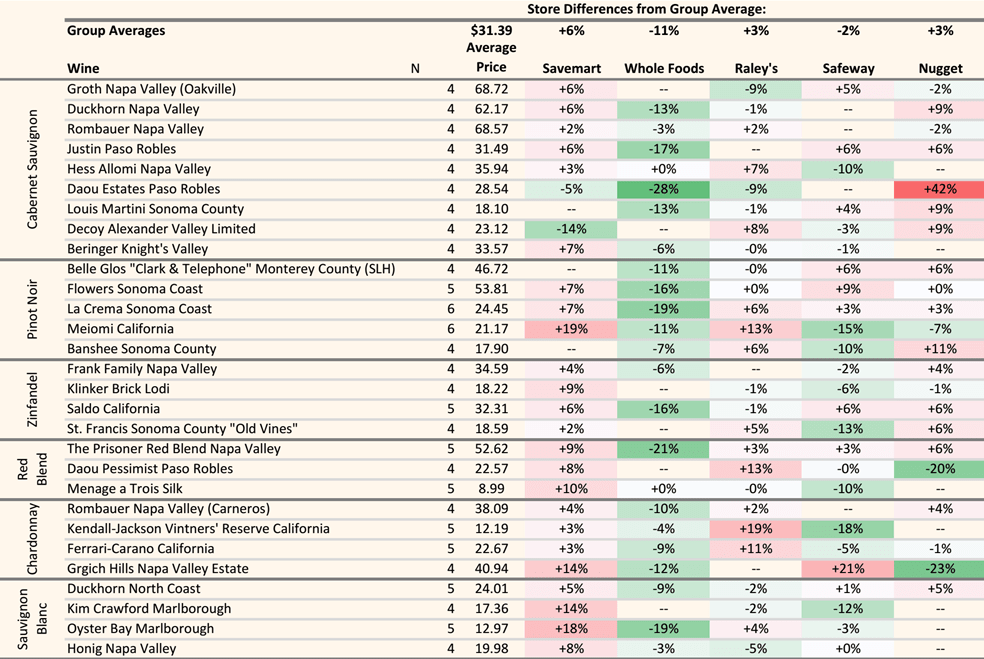

Given how much marketing science goes into the product lineup and pricing at supermarkets, I decided to look at the offerings of a few major supermarket wine aisles in Sacramento and compare them. I surveyed Savemart, Safeway, Raley’s, Whole Foods and Nugget Market. With a little bit of effort, I was able to find 29 wines that were offered in a minimum of 4 of the 5 stores (evidence of the commodification of the wine aisle). The array of wines included some low-priced wines, but no budget wines, and a few mid-price and premium wines. The table below shows the results. All the comparisons were based on the multi-bottle discount price. The table shows the “group average” price and the percentage difference in price at each store for that wine. Note that this survey of prices was a snapshot, and prices change for individual wines.

- Whole Foods was the cheapest on average, by 11 percent (thank you, Amazon!). I was impressed by the selection of wine at Whole Foods, too–more imported wine, and a few unexpected wines. I spent a fair amount of time snooping in the aisles of these stores, and Whole Foods was the only place where an actual store staffer assigned to the wine section approached me.

- Nugget Market had OK prices, and decent selection. It had by far the best “trophy wine” selection. Most supermarkets do have a “trophy wine” case, usually under lock-and-key (Nugget’s was not), of super-premium wines (Think: Caymus Napa Cabernet Sauvignon, Stag’s Leap Artemis Cabernet Sauvignon, Bollinger Champagne, etc.). Nugget’s trophy case was pretty amazing–if I had to buy a trophy wine as a gift at the last minute, for some reason, I would head to Nugget. It also had a lot of imported wines.

- Raley’s was OK on prices, and had a better-than-Savemart selection of wines.

- Safeway was OK on prices on average, but had a lot of highs and lows. Selection was OK, but light on imports and less popular varieties.

- Savemart had the highest prices, by 6 percent on average. To me, Savemart was the least interesting of the wine sections, too–very few imported wines.

Other notes:

- If you go to your average supermarket, and buy a single bottle of wine, you are pretty much the ideal customer, paying a premium of 20 percent or more for that bottle. We have all been there, on the way to a dinner or a party, in need of a gift bottle, and stopping off at the local Safeway to pick it up. In those rare instances, maybe that premium is worth paying. Just do not make it a habit!

- Total Wine had all but a couple of the listed in this comparison, and was 12 percent cheaper than the group average–so a bit lower than Whole Foods. Obviously, Total Wine will have a better selection than any of the supermarkets, too.

- I tried to include Walmart in this comparison, but the wine selection is pretty thin there.

Future of Supermarket Wine

In terms of commoditization of wine offered in supermarkets, it is certainly not going away, and will probably become more prevalent. Supermarkets are consolidating and growing ever bigger, as are the distributors that serve them. As that happens, commodity wines will be more and more attractive to both the stores and the distributors.

Premiumization is occurring in the wine market, as it is in many other retail products: producers enhancing the value of their product to consumers, but using higher quality materials, packaging, etc., and charging more for those products. The trophy shelves on the supermarket wine aisles I mentioned are one aspect of that, and it would not be surprising to see those trophy shelves get a bit bigger.

Store labels will become more prevalent. Given the success that Trader Joe’s and Costco (Kirkland) have had bottling wine under their own labels, it is surprising to me that supermarkets have not dived into this more already. Store labels generally do not mean someone from Safeway is out stomping grapes–the stores negotiate for wines from winemakers, and have the wines bottled and labeled under the store brand. This virtually cuts out the distributor, and the distributor’s profit, from the equation. Trader Joe’s and Kirkland wines are developing loyal followings, including an ecosystem of expert reviewers focused on those labels. Safeway (Signature Reserve, Vinafore, Kalyana, “O” Organics) and Whole Foods (Animist, Criterion, Wine Farmer, Songbird Cellars) have stuck their toes into this arena. Expect to see more of this soon.